Remain up-to-date with the latest assessments. We are going to hold you informed, and we'll in no way market your facts to anyone.

To stop violating the automatic stay, most credit card organizations will near your account once you file individual bankruptcy, whether or not your account is existing or paid off.

Lessening your dependence on credit cards may be an important phase towards rebuilding credit after personal bankruptcy. Even so, the strategic utilization of secured credit cards may also enable you begin to restore your trustworthiness inside the eyes of lenders.

As you understand that filing personal bankruptcy is definitely the financial debt reduction route you’ll take, it’s okay to stop making minimal credit card payments if doing this signifies you can afford necessities. Sure, this may ding your credit rating, however you can start off rebuilding that after your discharge is entered.

Let's say the name about the account I’m connecting to Experian Raise doesn’t match my Experian account?

That is dependent upon the type of individual bankruptcy you qualify for. By using a Chapter seven bankruptcy, your belongings is going to be offered (except perhaps your private home and motor vehicle), and also your creditors will likely be paid out off While using the proceeds.

Occasionally, your trustee could make the creditor hand around the payment. The money doesn’t go back to you, while. The trustee as a substitute divides it amid all of your creditors, so none of them gets chosen treatment more than the Other individuals.

History. Does the company have a lengthy heritage of Full Article efficiently supporting shoppers with their financial requirements? Is this an organization you are able to have faith in with credit card debt consolidation?

What if the name on the account I’m connecting to Experian Raise doesn’t match my Experian account?

3 minute go through • Upsolve is actually a nonprofit that can help you will get from credit card debt with education and learning and no cost personal debt find more information reduction equipment, like our personal bankruptcy filing Instrument.

In some instances, your trustee could make the creditor hand around the payment. The cash doesn’t go back to you, though. additional info The trustee instead divides it between all of your creditors, so none of these receives most well-liked treatment method above the Other people.

When you have an active home Get More Information loan account or every other lease tradeline with your Experian credit file, then your lease just isn't eligible either. he said Learn more.

SuperMoney hasn't existed as long as several of the referral platforms we evaluated and so there's not just as much customer opinions nonetheless. That is a great way to assemble details about personal loans you will be suitable for, but you'll nevertheless have to accomplish your software straight With all the lender you choose.

The trustee employs the proceeds to pay the creditors a percentage of the things they’re owed. Initial to generally be paid out are precedence statements, such as sure tax obligations and back again domestic support obligations. Very last to get paid are nonpriority, unsecured debts, like credit card balances and healthcare expenditures.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Michael C. Maronna Then & Now!

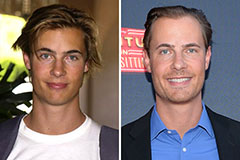

Michael C. Maronna Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Kelly Le Brock Then & Now!

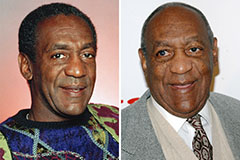

Kelly Le Brock Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!